tax act online stimulus check

Newer Post Older Post Home. Calculations are estimates based on the figures from the Consolidated Appropriations Act as.

Turbotax Irs Launch Online Portal For Stimulus Check Direct Deposit

Your stimulus payment will be direct deposited into your verified bank account.

. Service hours limited to designated scheduling times and by. In response we have created Stimulus Center where you can find the answers you need. 1400 in March 2021.

1 online tax filing solution for self-employed. A message from TaxAct President Curtis Campbell. You may soon receive a 1200 or 2400 stimulus check from the government if you set up your tax refund with direct deposit though it will be a longer wait if you need a paper check.

An Economic Impact Payment or EIP is a stimulus payment provided to taxpayers most recently for COVID-19 relief. Visit the TaxAct Stimulus Center for the latest details on the recently proposed third stimulus payment. Currently the second stimulus payout is as follows for those eligible.

Securely access your IRS online account to view the total of your first second and third Economic Impact Payment amounts under the Tax Records page. Households will receive an additional 1400 for. Check out our Form 1040 Recovery Rebate Credit FAQ page for instructions on how to report your stimulus payment using any TaxAct product.

Securely access your individual IRS account online to view the total of your first second and third Economic Impact Payment amounts under the Economic Impact Payment Information section on the Tax Records page. Online competitor data is extrapolated from press releases and SEC filings. According to the IRS a taxpayer is eligible if you were a US.

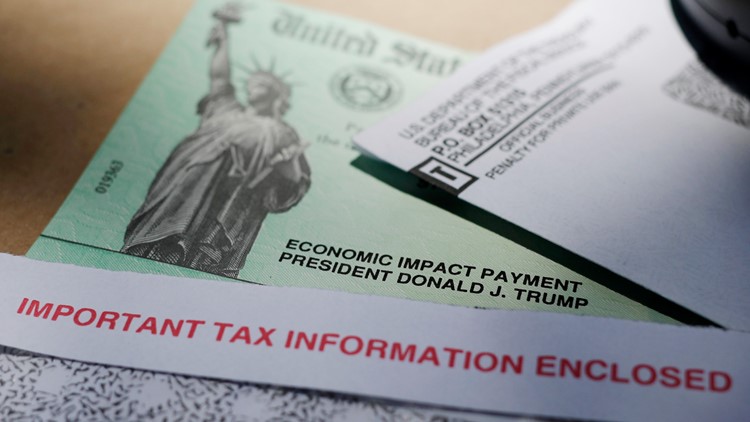

Third Stimulus Checks Should You File Your Taxes to the. The eligibility requirements for the second stimulus payment are the same as the first round of payments issued earlier in 2020. These payments were sent by direct deposit to a bank account or by mail as a paper check or a debit card.

1200 in April 2020. The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible. Stimulus payments erroneously sent to closed or incorrect bank accounts by the IRS are being redirected.

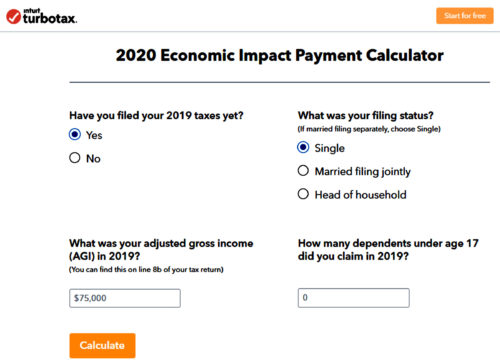

Married taxpayers who file jointly with an AGI of 150000 or less will receive 2800. Please visit the Stimulus Center often as changes are happening fast. The third stimulus provides 1400 to individuals with an adjusted gross income AGI of 75000 or less.

Iklan Tengah Artikel 1. Through March 2022 well also send Letter 6475 to the address we have on file for you confirming the total amount of your third. My original check was thrown out by a careless roommate I live abroad and they thought it was junk mail but it was never cashed.

We mailed these notices to the address we have on file. I used Tax Slayer and am having the same problem. Up to 10 cash back Get the latest updates on the 3rd stimulus check including stimulus payment dates a stimulus calculator details on the stimulus package and more.

Taxpayers who file head of household with an AGI under 112500 will receive a 1400 stimulus payment. Tax act online stimulus check Tuesday June 14 2022 Edit. Transcript says 14 and the check my payment or whatever its called shows status not available.

People who are missing stimulus payments should review the information on the Recovery Rebate Credit page to determine their eligibility to claim the credit for tax year 2020 or 2021. 1998 - 2022 TaxAct. The second round of stimulus payments are based on the information reported on your 2019 tax return.

Individuals can view the total amount of their third Economic Impact Payments through their individual Online Account. I was told because we chose to pay our tax preparation fee out of our 2019 refund the stimulus was deposited into their HR Block bank account instead of. Your Online Account.

Im so confused on whats going on and our stimulus is no where to be found. You can find information about previous stimulus payments as well as the latest third round of payments. Posted by 1 year ago.

Most eligible people already received their Economic Impact Payments. Enter and verify bank account information complete all steps. At TaxAct we know you have a lot of questions about stimulus payments.

To enter or review your Recovery Rebate aka stimulus payment information in TaxAct follow these steps. You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return. Securely access your IRS online account to view the total of your first second and third Economic Impact Payment amounts under the Tax Records page.

Once you answer those questions the TaxAct product will let you know if you qualify for additional stimulus funds or if you received the correct amount. Jackson Hewitt and TaxAct say missing stimulus checks will be deposited starting Feb. We use chase for our bank.

Resident alien in 2020 are not a dependent of another taxpayer for tax year 2020 and have a social security number valid for employment that is issued before the. Click Add Form 1099-INT. The IRS has issued all first second and third Economic Impact Payments.

Available to certain users of TaxActs online consumer 1040 product for an additional charge. 600 in December 2020January 2021. How many from TaxAct have finally gotten their stimmy.

RELIEF Act Stimulus Portal To check your eligibility for a RELIEF Act stimulus payment enter the information. We filed with Tax Act and had our fees taken out of our return. Last week the latest details of the third COVID-19 relief package were released.

Now Available Taxact S Free Stimulus Registration Service Taxact Blog 600 Second Stimulus Check Calculator Forbes Advisor Look For Line 30 On Your 1040 To Claim Your Stimulus Payment The Washington Post Share this post. People who are missing stimulus payments should review the information on the Recovery Rebate Credit page to determine their eligibility to claim the credit for tax year 2020 or 2021. The important details you want to know.

Shows the first. TaxAct Xpert Assist. Enter 1 in Box 1 Interest income.

112500 and 136500 for head of household. The package which is expected to pass Congress in the coming weeks includes a 1400 stimulus payment for individuals and both child and non-child dependents. COVID-19 Stimulus Checks for Individuals.

Click Review bank account information. Still havent even received a single stimulus check Hey all I filed my taxes for 2019 and 2020 and have yet to receive a single stimulus payment.

How Nonfilers Can Get Stimulus Checks Including Those Experiencing Homelessness Cnet

Look For Line 30 On Your 1040 To Claim Your Stimulus Payment The Washington Post

How To Claim Missing Stimulus Payments On Your 2020 Tax Return

All You Wanted To Know About Those Tax Stimulus Checks But Were Afraid To Ask

The Irs Is Still Issuing Third Stimulus Checks We Ve Got Answers To Your Faqs Forbes Advisor

Your Third Stimulus Check Is Coming Soon Here S How To Prepare

Register For Your Stimulus Payment Free Easy Online Cares Act

U S Expats Coronavirus Stimulus Checks Top Faqs H R Block

Stimulus Checks Won T Be Taxed But Unemployment Benefits Will Be Cnn Politics

Where To Add Your Stimulus Money On Your Tax Return Taxact

Register For Your Stimulus Payment Free Easy Online Cares Act

Stimulus Registration Economic Impact Payments Taxact

Important Updates On The Second Stimulus Checks Taxact Blog

Second Stimulus Check Track The Status Of Your 600 Payment 12newsnow Com

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Stimulus Payments May Be Offset By Tax Debt The Washington Post

How To Claim A Missing Stimulus Check

600 Second Stimulus Check Calculator Forbes Advisor

How To Get A Stimulus Check If You Don T File Taxes Updated For 2021